The Four Pillars of Personal Finance

If you have some money sitting in your bank account and you’re not sure what to do with it, you’re not alone. Many people find themselves in this exact situation, and the confusion often leads them to make impulsive decisions: jumping into risky investments they don’t understand, or letting their money lose value to inflation while it sits idle.

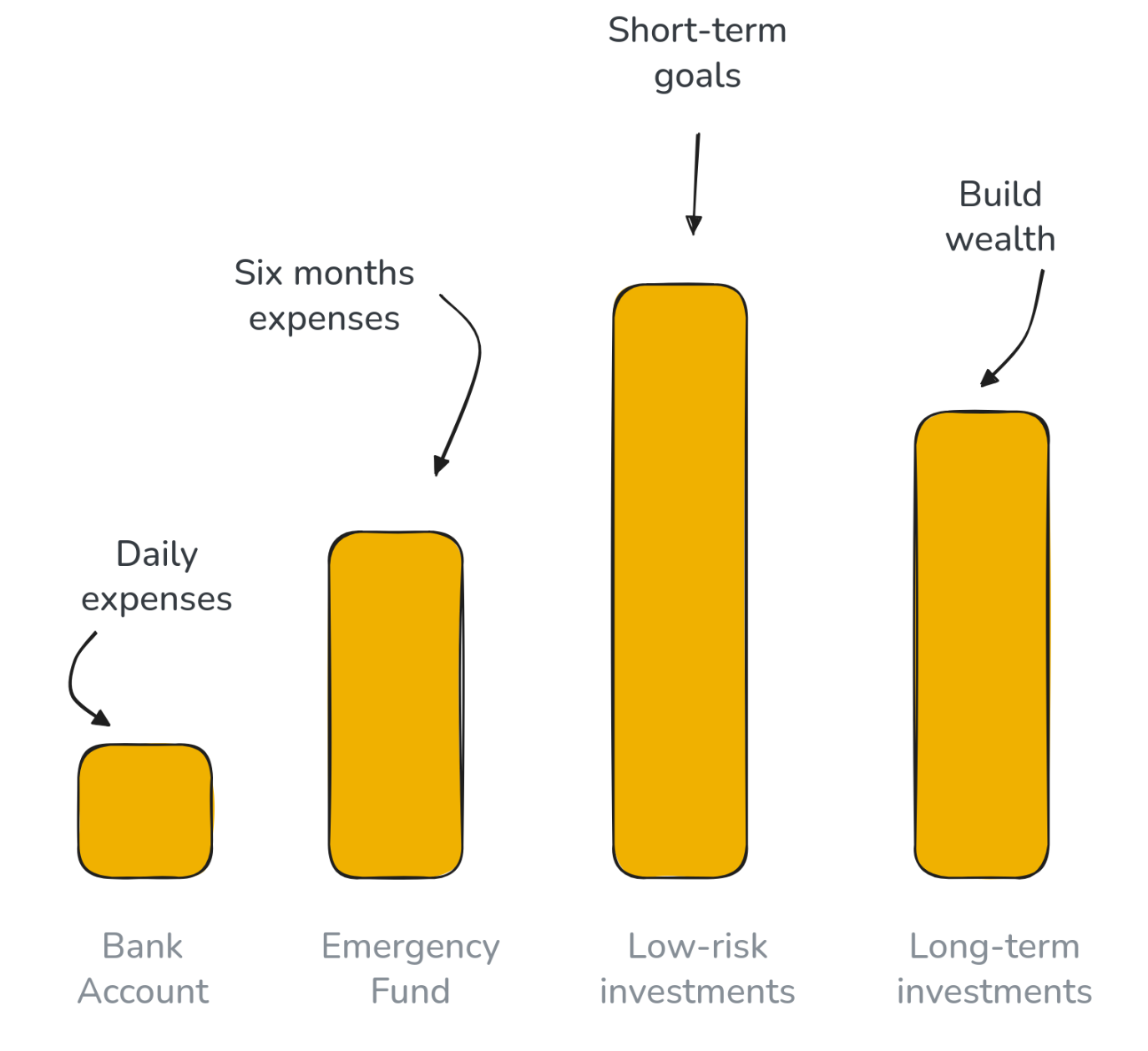

Personal finance doesn’t have to be complicated. In fact, it becomes surprisingly straightforward once you understand a few basic steps. In this article, we’ll walk through what we call the four pillars of personal finance: a simple framework that helps you cover your day-to-day needs, protect yourself from unexpected expenses, save for future goals, and grow your wealth over time.

First Pillar: Money for Monthly Living

This is the simplest one: keep enough cash in your regular bank account to cover your monthly expenses. Rent, groceries, utilities, transportation: all the things you pay for every month.

This money needs to be immediately available and you’re not trying to make it grow. Your regular bank account is perfect for this.

How much you keep in this pillar depends on your needs. Look at your last few months of expenses and keep roughly that amount accessible. Some months you’ll spend more, some less, but you want enough cushion that you’re not constantly transferring money around or worrying about overdrafts.

Second Pillar: Your Emergency Fund

Life has a way of throwing curveballs. Your car breaks down, your laptop dies, you need an unexpected medical procedure, your refrigerator gives up the ghost.

This pillar is about being prepared for these moments without derailing your entire financial life. You want money that’s safe and available immediatly or within a few days when you need it, but that can sit untouched (and maybe earn a little interest) until then.

A good rule of thumb is to build up three to six months’ worth of expenses, and it’s perfectly fine to go up to twelve months if you’re providing for others or if a larger cushion simply gives you peace of mind. If you spend $2,000 a month, aim for $6,000 to $12,000 in your emergency fund. If this sounds like a lot, remember that you can build it up over time by setting aside a bit of money each month. Even small, consistent contributions add up.

Keep this money in a savings account that offers decent interest rates while allowing you to access your funds quickly when needed. The goal is to preserve your capital while earning some return, so avoid anything that might lose value right when you need it most.

Third Pillar: Money for Known Future Expenses

Now we’re getting more strategic. This pillar is for things you know are coming, or are pretty sure will happen, within the next ten years.

Maybe you’re planning to buy a car in three years. Perhaps you want to take a big trip in five years. You might need a down payment for a house, or you’re saving for a wedding. These aren’t emergencies, they’re goals with timelines.

For these goals, you can afford to take a tiny bit more risk than with your emergency fund, but not much. You know roughly when you’ll need this money, so you can’t let it swing wildly in value. If your car dies in year three and the market happens to be down 20% that month, you’re in trouble.

The exact tools for this vary, but usually low-risk bonds or high-yield savings accounts work well for this pillar. In some cases, you might use the same type of account you have for your emergency fund, but it’s important to keep these savings separate so you can withdraw them independently.

Fourth Pillar: Long-Term Wealth Building

This pillar is for money you absolutely won’t need for at least ten years (ideally fifteen or more). For this pillar, you’ll be investing in the stock market, and the timeline is crucial. Over long periods, stocks have historically provided the best returns: typically around 7-8% per year on average. But here’s the catch: “on average” means some years are great (up 20% or more) and some years are terrible (down 30% or worse).

If you might need your money in two years and the market drops 25% in year one, you’re in a bad spot. But if you have fifteen years, history shows that those short-term drops become irrelevant. The market has always recovered and grown over long periods.

It’s important to keep in mind that even though stocks tend to be less risky over long periods, there’s still risk involved. Perhaps the biggest risk isn’t the market itself, but human behavior: watching your investments drop 20% or 30% can be frightening, and many people panic and sell at a loss, locking in their losses permanently. For this reason, the fourth pillar is optional. It’s perfectly fine to stop at the third pillar if you’re not comfortable with stock investments. A solid financial foundation built on the first three pillars is already a huge achievement.

Why This Order Matters

When approaching personal finance, it’s tempting to jump straight to investing because it seems more exciting, but you need to build these pillars in order.

Many people get this backwards. They see investing as exciting and emergency funds as boring, so they skip straight to pillar four. Then life happens, they have no cushion, and they end up in debt or forced to sell investments at a loss.

Start with pillar one. Once that’s solid, build pillar two. Then three. Then, and only then, focus seriously on pillar four.

Getting Started

If this feels overwhelming, just focus on the first step: make sure you can cover next month’s expenses, then start building your emergency fund. Even saving $50 or $100 a month adds up faster than you think.

Personal finance isn’t about being perfect. It’s about being prepared, thinking ahead, and making your money work for you. Build your foundation first, the rest will follow.