Learn to invest.

Put it in action.

Zearn the basics of personal finance and complete simple quests to grow your savings, one step at a time.

No credit card required.

HOW IT WORKS

Take control of your money in 3 steps

1. Understand

Start by assessing what you already have and finding the gaps in your financial plan.

2. Manage

With saveabit, you'll get actionable advice in the form of quests that helps you strengthen your finances step by step.

3. Grow

With a solid foundation, focus on growing your wealth over time through investments and keeping it aligned with your life goals.

WHY

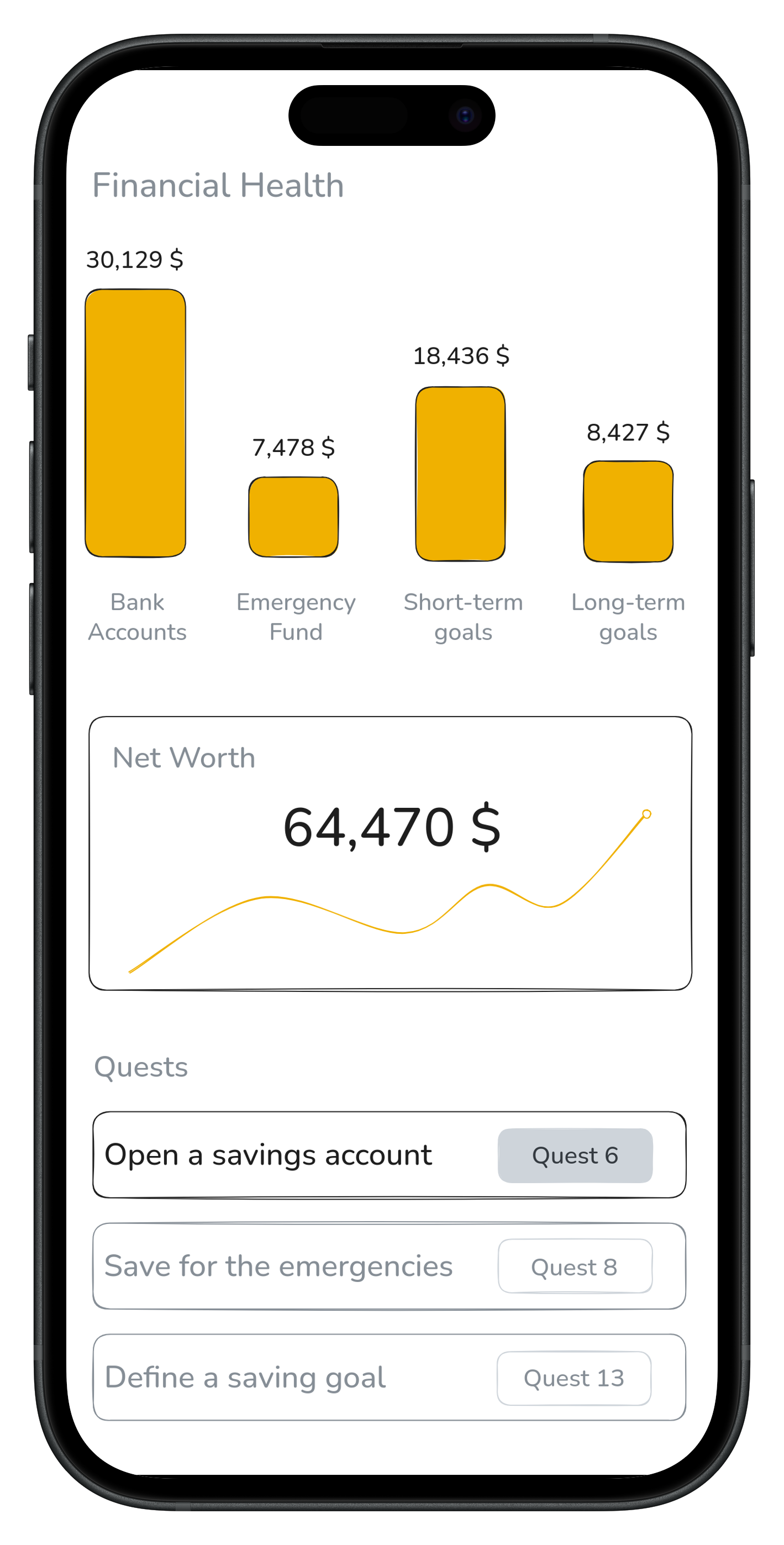

Not just charts. Real guidance to manage your money.

We guide you

Other apps stop at showing balances and expenses, we go further. Step by step, saveabit helps you build a solid financial structure. Start with your daily expenses, then build an emergency fund, and finally, if you're ready, move to investments.

We don't assume you already know finance

Most apps expect you to come prepared; we don't. saveabit includes short and easy lessons that give you the financial basics: why inflation matters, how to balance savings, and how to manage accounts. You can learn while managing your money.

We focus on the big picture

Tracking every cent is tiring, especially if done manually. Instead, you should focus on what really matters. saveabit help your create a clear monthly overview of your spending and savings. Ten minutes a month is enough to stay on top of things without the hassle.

We respect your freedom

Your situation matters whether you're single, a couple, or a family. saveabit suggestions are tailored to your context. You can adjust everything to your needs, but you also get an opinionated framework to follow if you don't know where to begin.

REVIEWS

Full disclosure: some of these reviews might be fake.

Be our first real voice.

Frequently Asked Questions

Why should I choose saveabit over other personal finance apps?

There are many personal finance apps, each designed for different needs. saveabit is for people who aren't experts and want guidance on how to manage their money, not just another tool to track transactions.

Who's behind saveabit?

saveabit is built by Pinched Labs, a team of two young Italian developers. We first started digging into personal finance for ourselves and quickly realized how many people still struggle with it. That's when we decided to give it a try and build something useful. With saveabit, our mission is to help people get their finances back in shape without falling for “finance gurus” or get rich quick schemes. At the same time, we hope to turn this into a sustainable way of living for us too.

What are the future plans for saveabit?

Our goal is to keep saveabit simple, sustainable, and profitable without growing into a large company. We don't plan to add unnecessary features, ads, tricky pricing schemes, or to sell the app.

Will saveabit sell my information for ads?

No. We will never sell your data for advertising or any other purpose. We don't run ads, we don't track users, and we only collect the minimum information needed to provide the app.

Can I use saveabit anonymously?

Yes. When you sign up, we only ask for a username and a valid email address. We don't request your name, location, or any other personal details.

Do you have access to my bank account or credit card?

No, we will never have access to your money or credit cards. You will always be in control of that.

What is the price of saveabit?

saveabit is currently in private beta and free to use. It will become a paid app in the future, although we haven't set the exact date or pricing yet. Beta testers will be offered special plans when that happens.

Is my data safe with saveabit?

Yes. Your data is encrypted both on disk and in transit using industry-standard security practices.

Does saveabit work on mobile devices?

Yes. saveabit is a mobile-only app. While it won't have every feature of a desktop tool, we see this as a strength: it keeps the app simple, quick, and easy to use.

Does saveabit support shared accounts or teams?

Not yet. If you want to use saveabit with another person, you'll need to create a single account and share the login credentials.